Nobody Remembers What Happened to Cisco

Nobody remembers what happened to Cisco.

Today's younger investors weren't there for it. I wasn't there for it. Our Gen X clients were there, but not in a meaningful way.

The older generations were there. They may remember what happened. But time has a way of fogging the glass through which we see the past. Memory gets selective. We remember the lessons we want to remember, forget the ones that run counter to the narrative we currently favor.

So, here's the story:

Cisco Systems IPO'd in 1990 with promises of revolutionizing business infrastructure. They powered the evolution of the internet with multi-protocol routers, switches and network equipment integratal to the creation of the expanding digital landscape. Much like Nvidia today, they produced the necessary items on which everything was built.

The enthusiasm took hold. The story was compelling. Investors could see the future, and they weren’t wrong. The internet was going to change everything - and it did.

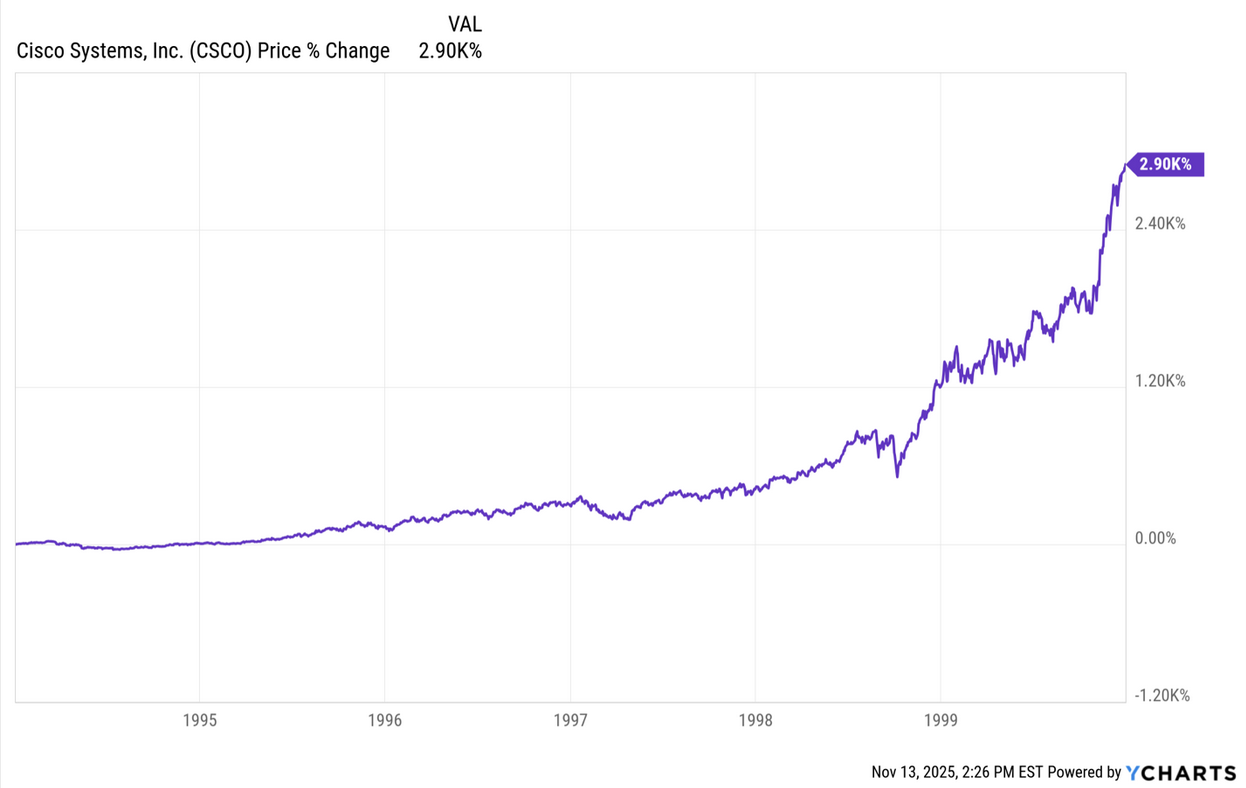

In 1995, Cisco traded at a reasonable P.E. ratio in the 20s – expensive, but justifiably so. By 1999, as the dot-com frenzy accelerated, that ratio had ballooned. At its peak in March 2000, Cisco's P.E. ratio nearly cracked 200.

The stock had shot up over 4,000% from its IPO. We're talking about valuations that made even the most optimistic bulls squirm a little. Or should have, anyway.

Then the bubble popped.

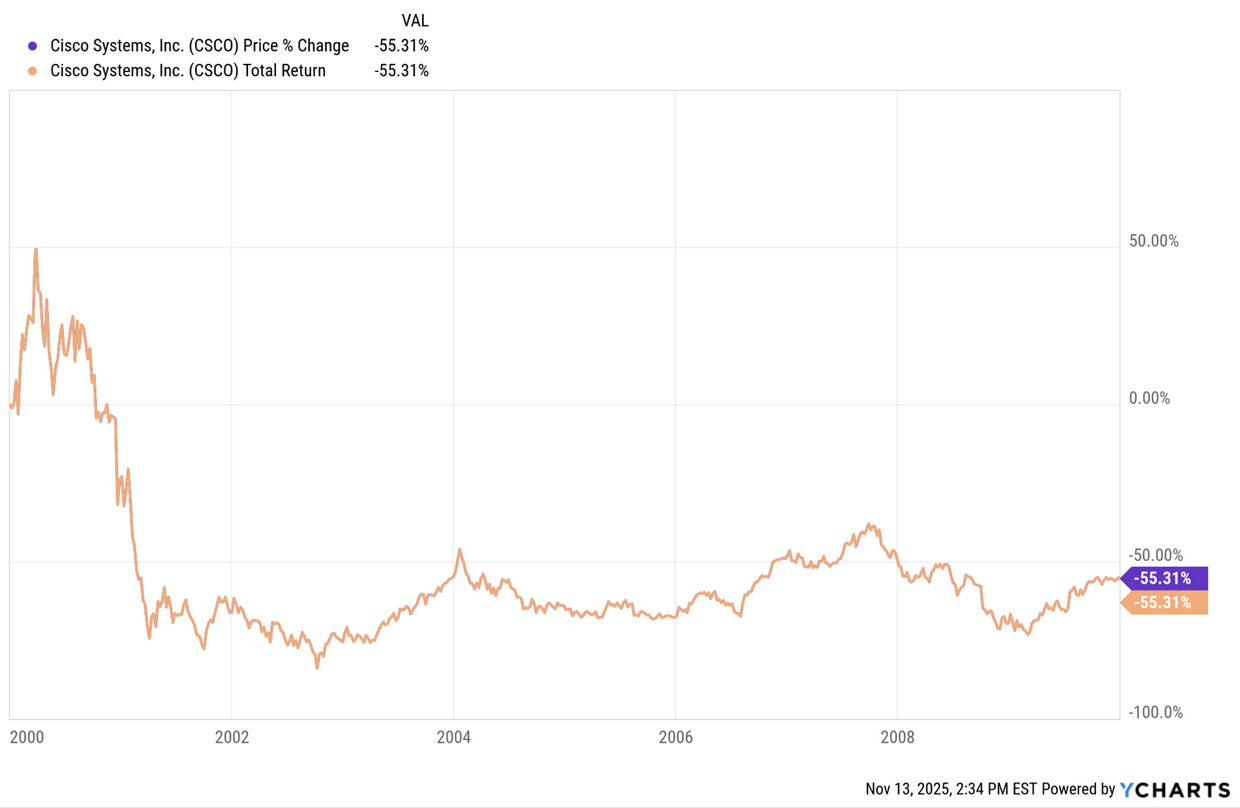

Cisco plunged over 50% in a matter of months. Then kept falling. Things had gone too far, too fast. The classic story of irrational exuberance meeting the cold reality of gravity.

The stock ended up flattened, down over 80% from its high.

But here's where it gets interesting.

Cisco was a real company making real products and selling them for real money. Their business continued to grow, to justify their stock price. The fundamentals were sound. They weren't some vaporware company with a flashy website and a dream. They were the real deal.

The products worked. Post-bubble, the business remained. The customers kept buying. The revenue kept coming in.

But the stock price didn't grow. Not at the same rate as the business, anyway. If you’d bought the stock on the first trading day of the year 2000 and held it for 10 years, you were still under water on your initial investment.

And to this day, 25 years later, the stock has still not reached the all-time highs achieved way back when. Let that sink in for a moment. A quarter century of business growth, product innovation, market expansion - and the stock price is still underwater from its 2000 peak.

There's a lot of tech-bubble-A.I.-bubble comparison floating around out there, and for good reason. There are similarities in the company exuberance, the build out of AI infrastructure, the breathless "this changes everything" proclamations we hear at every conference and in every pitch deck.

But the most common differentiator I hear pointed out is that it's different this time - those tech bubble companies weren't profitable, but these A.I. companies are. Nvidia and the rest of the Magnificent Seven are real companies making real money.

Real products. Real customers. Real revenue.

But so was Cisco.

I say this not as a warning, but as a reminder. Great companies can and with some frequency have suffered 50% stock declines. Sometimes they take decades to recover. Sometimes they never do, even when the business itself thrives.

Being aware of that risk doesn't necessarily mean you should avoid it. But at the very least it should impact your decision-making.

It should inform how much you allocate. It should shape your timeline expectations. It should remind you that valuation matters, even for great companies.

If you're heavily weighted in tech, or if you've let your winners run to the point where they've become an outsized portion of your portfolio, maybe it's time to rebalance. Take some wins. Lock in gains. Diversify into areas that aren't trading at peak euphoria valuations.

Or don't. Maybe this time really is different. Maybe AI transforms productivity so dramatically that today's valuations look quaint in hindsight.

But remember Cisco. Remember that being right about the technology and being right about the stock price are two very different things.

We think about these risks. We consider them, discuss them, and adjust accordingly. Not because we're pessimists, but because we're realists.

Your portfolio should reflect reality, not hope.