Perspective Over Prediction

As we turn the page from 2025 to 2026, it’s easy to feel caught between the headlines of the day and the reality of your long-term goals. We often find ourselves searching for a sign that 'this time is different,' yet history suggests that the most successful paths are built on consistency, not timing. As we reflect back on last year, Wheeler takes a look at the stabilizing economic data that gives us reason for cautious optimism, while Colin explores why tuning out the noise and trusting your personal 'system' remains the most powerful tool in your shed. Together, they offer a roadmap for moving into the new year with clarity, discipline, and peace of mind.

2025 was a divergent year, difficult to digest and full of contradictions. In the face of political unrest, a troubled housing market, weakening employment and higher prices, the stock market bulled along to its third straight year of double-digit returns. It did this both because of and despite the A.I. boom, which initially served as a force of propulsion and later played the role of anxiety instigator. Inversely, the market increased both despite and because of political influence, a self-inflicted Tariff Tantrum selloff followed by the realization that things wouldn’t be as bad as we were bluntly led to believe on “Liberation Day.”

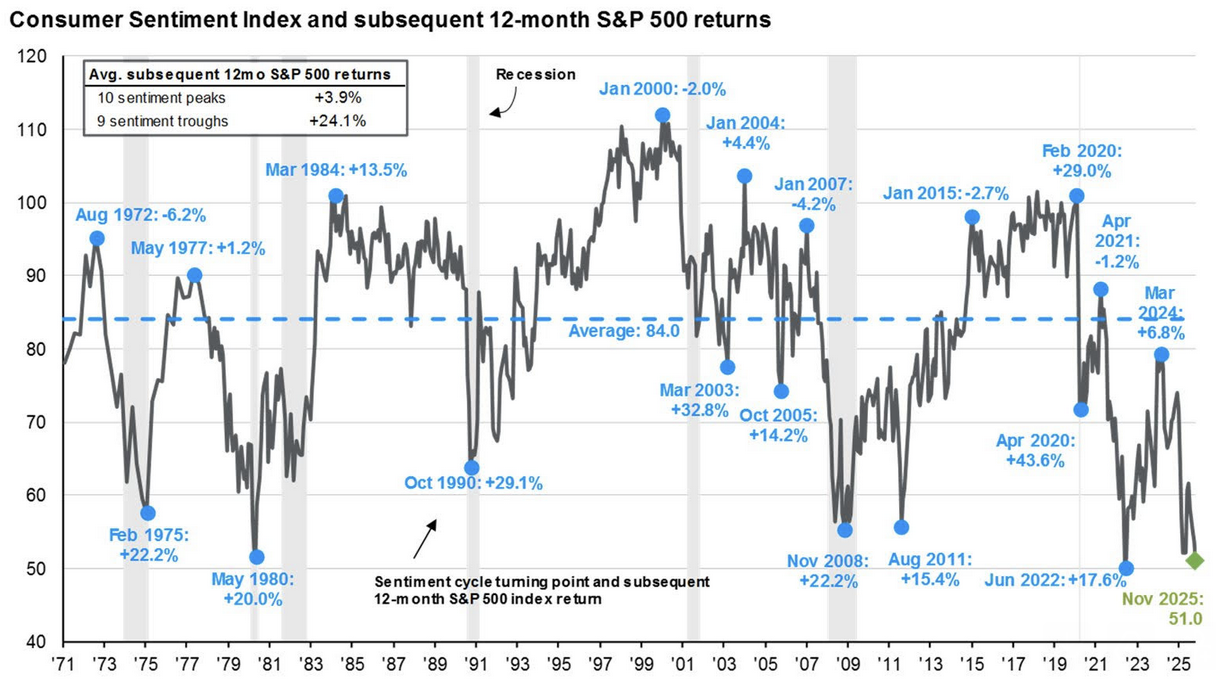

Looking back, it’s easy to see why the markets are left with a wall of worry to climb, a pit of uncertainty to cross. And it’s easy to see why consumer sentiment is at all-time lows. And yet – and it feels weird to say this after a year in which the S&P500 increased by above average numbers AGAIN – this may be a case of the “darkest before the dawn.”

This is my favorite chart from JP Morgan’s latest Guide to the Markets report. It shows stock market returns following peaks and troughs in consumer sentiment. We are undoubtedly in a trough.Interestingly, troughs in sentiment tend to precede strong equity returns while peaks in sentiment do not see as much upside.

Why would 2026 be better than 2025? Maybe it won’t be. Maybe we haven’t quite troughed yet. Or maybe this time will be different. But there are a few things I’ll be watching in 2026 that, if continued, would seem to set a more optimistic backdrop.

Inflation is normalizing – prices are still high relative to what we we’re used to, but our relationship with prices is also normalizing. We’ll get used to them. We always do.

Unemployment is higher, but actually more in line with historical averages. We’re finishing 2025 at a relative high of 4.6% civilian unemployment, but 6.1% is the 50-year average.

Labor productivity is increasing. Company earnings have proved strong. And when everyone is panicked about a potential bubble, it makes it difficult for said bubble to actually inflate.

So I’m going into 2026 cautiously optimistic. I’m channeling my inner Adam Duritz when I say that maybe this year will be better than the last.

2025 was a year filled with noise. Tariffs, wars, recession fears, inflation, politics—you name it. It felt like every headline was designed to make people anxious. And yet, despite all of that, markets continued to move forward and inflation came down meaningfully. As usual, the people who panicked and made big changes missed out on a strong year, while the people who stayed the course were rewarded. The market has always favored consistency and good systems over emotion. In fact, history shows that missing just a handful of the market’s best days can dramatically reduce long-term returns.

As we head into 2026, the noise isn’t going away—and that’s okay. The talks of “this time is different” will continue because fear sells, but it’s rarely helpful. If you’re more than four years from retirement and markets pull back, that’s actually good news—things are on sale. If you’re within four years of retirement or retired and haven’t bucketed your investments yet, that’s an easy fix and one that brings real peace of mind. Setting aside several years of planned spending allows you to weather any storm and still take that trip you’ve been dreaming about. Even the best economists in the world are right about half the time—and even Warren Buffett has had long stretches of underperformance. What mattered most wasn’t prediction, it was discipline and avoiding forced decisions.

Coming into 2026, remember your system, stay disciplined, enjoy life, and trust the plan.