The Death of the 60/40 Portfolio…Again

I’m going to assume if you’re reading this newsletter, you’re at least quasi-interested in investment strategies, market returns, stocks, bonds, portfolio management et all. But if I’ve learned anything working with clients over the past 15+ years it’s that this interest comes in a range of levels, ebbs and flows as the markets or years go by and is anything but universal. So, if the only thing you need to know is that your team at CoFi Advisors thinks about the market, how it’s changing and where it’s staying the same, and how we should best navigate that, then I’m happy to leave it there.

If you’re curious enough to stick around and see where I’m going with this, then let’s quickly lay some groundwork:

• People invest in stocks, primarily, to make money.

• People invest in bonds, primarily to make less money while taking less risk.

• In the 1950s, a man named Harry Markowitz began to popularize the idea that a diversified portfolio should have exposure, primarily, to both stocks and bonds. How much you have allocated to each category depended on the level of risk you wanted to take. This is the birth of Modern Portfolio Theory.

• An allocation of 60% stocks, 40% bonds became particularly popular, with the stock allocation aimed to capture long-term equity growth, and the 40% bond portfolio allocated to provide income and help buffer volatility.

• By the 1980s and 1990s, the 60/40 mix was widely adopted by pension funds, endowments, and retail investors.

• The strategy work particularly well in the Golden Age deflationary period from the late 80s to the mid-2010s, when falling interest rates and strong equity performance made the 60/40 strategy highly effective.

• Bonds not only provided steady income but also often rallied during equity downturns, giving the portfolio resilience.

• Then in the early 2020s the market shed its Golden Era and moved into The COVID Era, and almost as quickly as a Taylor Swift wardrobe change, we found ourselves playing by new rules and setting new expectations. Well, some of us more quickly than others.

During the peak market turmoil in early 2020, stocks and bonds both reacted negatively to the crisis shock. Bonds provided more stability, but still lost value, with the US Aggregate bond market rapidly down a quick 10%.

How often had such a move in the Agg occurred? Almost never. Dating back to the creation of the Agg as an index in 1986, a decline of this magnitude occurred only one other time, much more slowly and in the very worst days of the 2008 financial crisis.

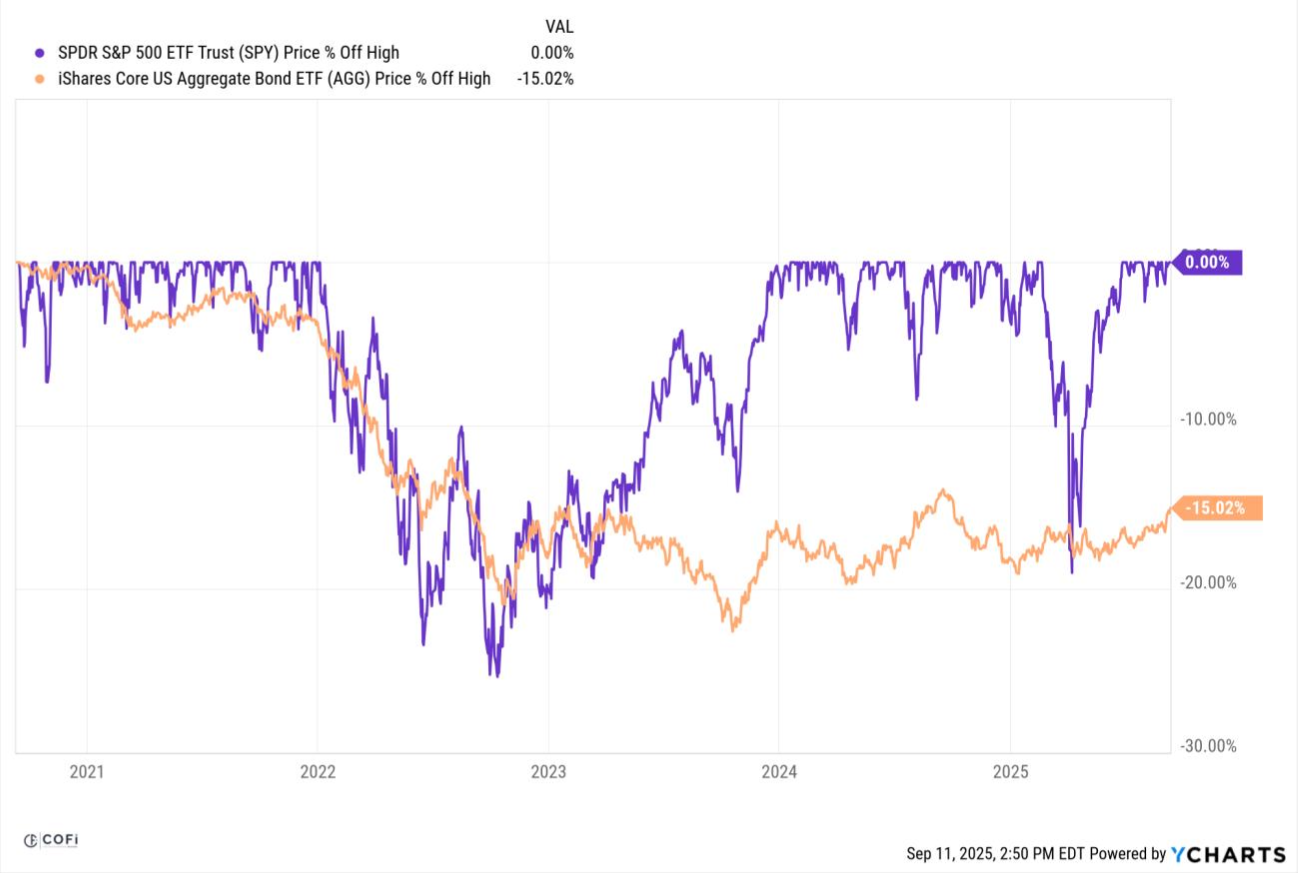

In retrospect this looks like a tremor before the bigger earthquake to come. In 2022 the Fed raged through a series of epic rate hikes, sending both stocks AND bonds downward in the same direction.

The Agg has yet to recover from these lows, while the S&P500 and its brethren have gone on to rally to multiple new all-time highs. The promise of interest rate cuts has kept the heart beating, but otherwise this area of the investment universe has looked a lot like a corpse.

I’m picking on the Agg here by looking at just the value of the bonds without factoring in the total return you get when you include interest payments, but only to make a point – what once was a tried-and-true strategy has lately proved to be anything but.

Simultaneously we’ve seen a rise of alternative investments, private credit/private equity, a resurgence in the price of gold, and the increasing value of digital investments like Bitcoin and Ethereum. Almost any combination of the above has given you better overall returns than a 60/40 bond portfolio this decade.

This is due, at least in part, to the interest shown by investors. As these alternative investments have risen in popularity, they’ve pulled money that otherwise would have been invested somewhere else. In some cases, that might be stocks. In most cases, it’s likely to be bonds. Why sell stocks when stocks are working and you can pull money from a lagging asset class and book a taxable loss to boot?

Not to mention the army of Wall Street salespeople incentivized to sell sell sell investments they can actually charge a fee on. With the fees charged for bond and stock portfolios in a race to the bottom, asset managers have turned their attention towards the vehicles they can still make money on. Now you have The White House “democratizing access toalternative assets for 401(k) investors” and pushing to make higher fee investments a focal point of your company sponsored retirement plan.

As alternative asset classes become more and more the norm, we have more and more to navigate. It doesn’t matter how much money you save on fees if your investment won’t rise on lack of strategic interest.

If a bond tree falls in the forest and no one is there to buy it… well, you know the rest.

All of which is to say that what has worked isn’t necessarily always going to work. “Past returns are not a guarantee of future results” is an old compliance adage in this industry, and for good reason.

The easy button is broken, perhaps irreparably. Inflation has returned, and higher prices are sticking around. It’s getting harder from here, not easier.

So we think about it. We consider the options, rethink, and leave room to change our minds. We adapt, because we must, because we have you.

You and your portfolios should adapt as well.

The information in this material is for general information only and is not intended to provide specific advice or recommendations for any individual.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that the strategies promoted will be successful.

All performance referenced is historical and there is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.