What if this isn’t an A.I. bubble?

I mean, of course it is, right? How could the enthusiasm, the massive company spending, the exuberance in the stock market, the sudden permeance of ChatGPT and its competitors in our everyday society – how could it NOT lead to a bubble? I’ve been saying this for over a year. I’ve been hearing it echoed back to me more and more.

A bubble is coming.

Everybody knows this.

But what if we’re all wrong?

In 2022, it appeared a recession would be imminent. Indicators were flashing red everywhere you looked. Inflation was hitting 40-year highs. The Fed was tightening rates rapidly in response, squeezing liquidity into a chokehold. Consumer sentiment was falling. The yield curve inverted, which was everyone’s favorite “look how smart I am” recession indicator to point to.

Then slowly, but surely, the layoffs came. The waves flowed through Big Tech as firms cut 3,000 jobs here, 5,000 jobs there.

The market went down, and down, and down until… it stopped. The recession never came. The measures taken in expectation of the recession seemed to actually prevent the recession. Seeing the threat coming down the pipe, companies AND households managed to tighten their grips, steer into the skid, and avoid the crash.

It helped that low interest rates allowed everyone to sure up their liabilities. It helped that the country’s energy independence enabled us to gain from the Ukraine war, as opposed to be pulled down by it. And it helped that Big Tech had vacuumed up so many employees during the post-COVID boom times, allowing for easier cuts to sure up their books and for many of those former employees to find numerous job opportunities.

There were many reasons we didn’t fall into a recession that year, but I think that key among them was the healthy amount of fear and risk awareness, and the choices made along the way because of this.

I see a lot of that fear now. I see a lot of choices being made with eyes wide open. People are worried. People are scared. About a lot of things, yes, but stock market risk and job risk are front of mind.

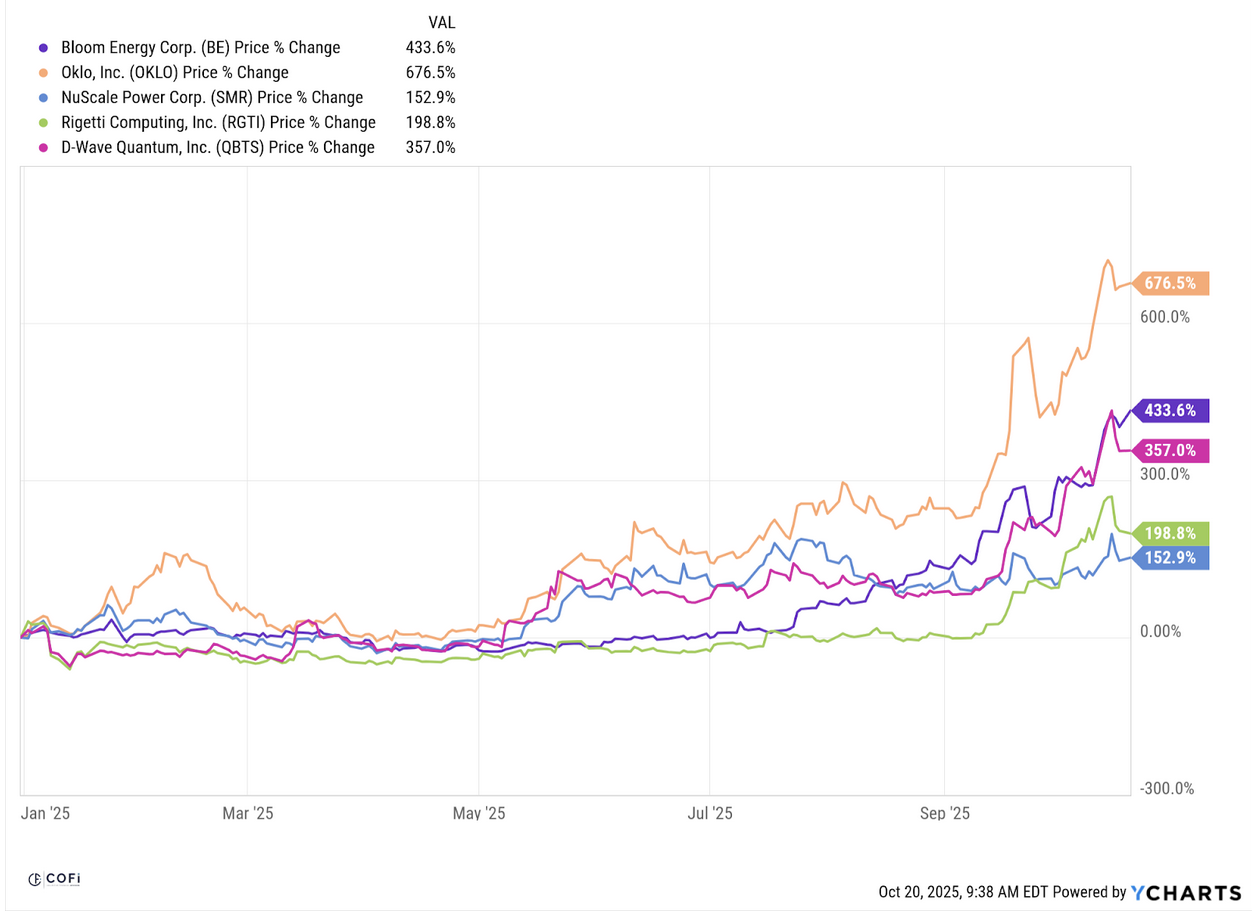

I don’t see that everywhere. Irrational exuberance has crept back into pockets of the market. I know more than one client who sees a return in their stock portfolio that is far outpacing the market, then looks at the returns of Oklo, Bloom Energy or D-Wave Quantum and decides they should be getting more.

FOMO is a real thing, folks. Who cares if half of these companies aren’t making any money, and the other half are trading at a PE 3 or 4 times the rest of the market? People are making money, so I should be to!

I have very little hope for these pockets of the market. And I know that most market risk is systemic. Big Tech is not impervious to the threats of an Oklo implosion. I have no doubt that people are using leverage to ride this most recent speculative wave. This is always the case, and the unwind is painful. But the chart above is what a mania looks like.

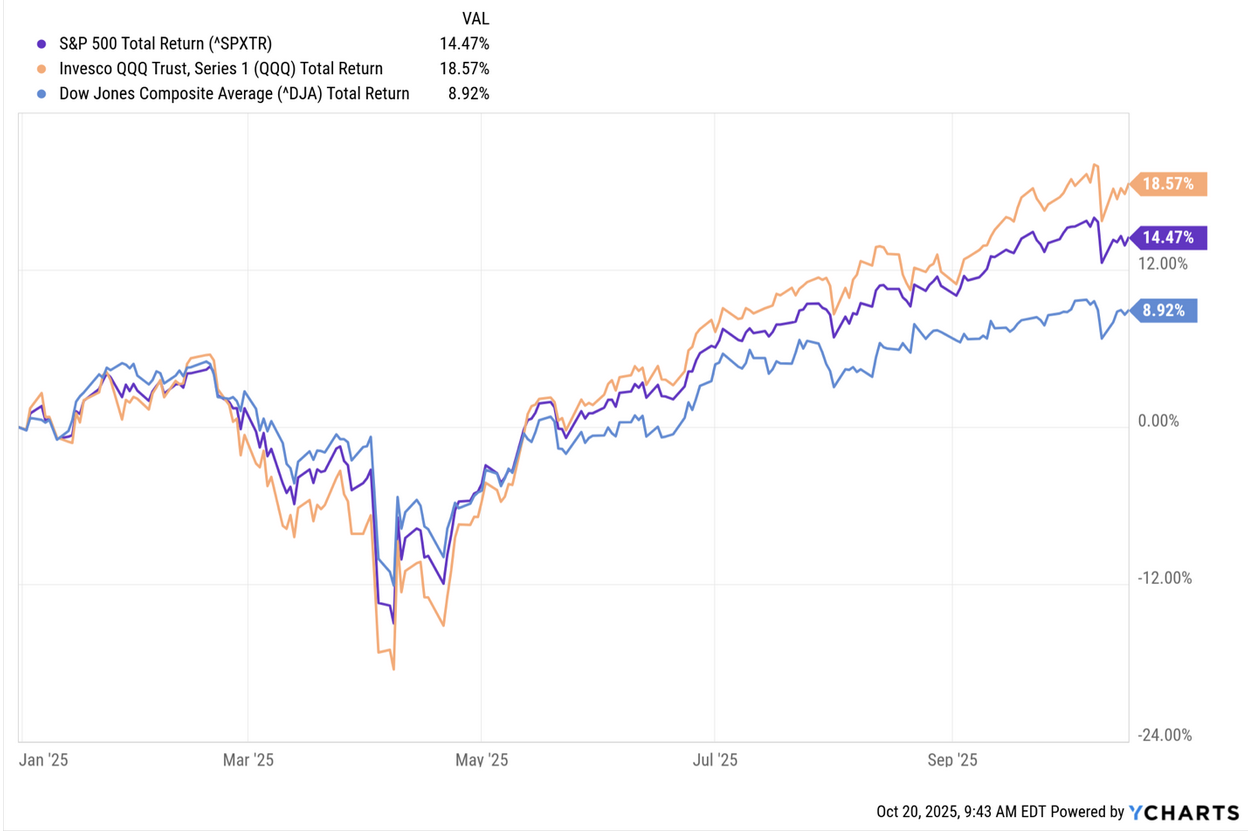

This is not:

There are many risks out there. And one of them may be an A.I. bubble. But what if by identifying this risk and preparing for it, we’re actually able to avoid it? Or at least lessen the damage.

So we’re approaching this with eyes wide open. With higher risks of job dislocation, we’re encouraging our clients to increase emergency reserves. With increasing (but far from unanimous) enthusiasm in the stock market, we’re looking for opportunities to take wins, rebalance into long-term strategies.

But we aren’t running away from a bull market. We’re maintaining exposure and participating in the market.

This is a bull market. You don’t need to take unnecessary risks that aren’t in alignment with your long-term plan in order to make money.